tax on unrealized gains bill

The tax on unrealized gains faces hurdles. The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold.

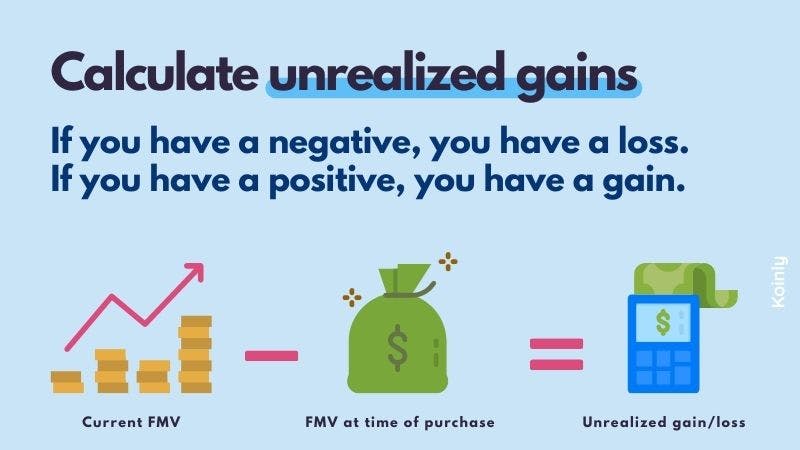

Crypto Tax Unrealized Gains Explained Koinly

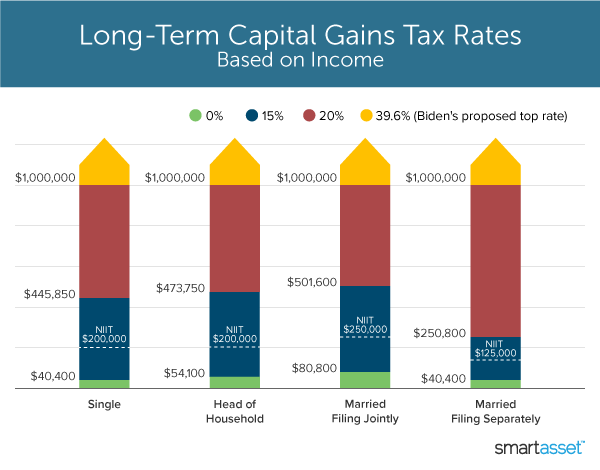

However not all realized gains are taxed at the same rate.

. Sarah SilbigerBloomberg via Getty Images. 0000 0138. Billionaires and their growing piles of.

The first of these is a proposal to implement a so-called mark-to-market regime for taxing unrealized capital gains. A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income. How Billionaires Like Musk Could Use Options to Cover the Bill.

Unrealized Capital Gains are Not Part of Income. House Speaker Nancy Pelosi took issue with plans by fellow Democrats to levy a tax on unrealized capital gains to help pay for President Bidens 175 trillion social spending bill. Unrealized gains Before we jump into what an unrealized gain is you need to understand what a realized gain is.

When the wealthiest families incur income taxes on capital gains they pay a top 238 federal tax rate on the transaction lower than the top 37 rate on income like wages. In reality it is a tax on wealth. Learn everything you need to know about unrealized gains and losses and how they can help reduce your tax bill.

Unrealized capital gains are increases in value of stock purchases. You dont incur a tax liability until you sell your investment and realize the gain. This article is in your queue.

To prohibit the implementation of unrealized capital gains taxation. The impacted assets include stocks bonds real estate and art. Of all the many revenue-raising ideas that have bubbled up out of Washington the recent proposal to tax unrealized capital gains is.

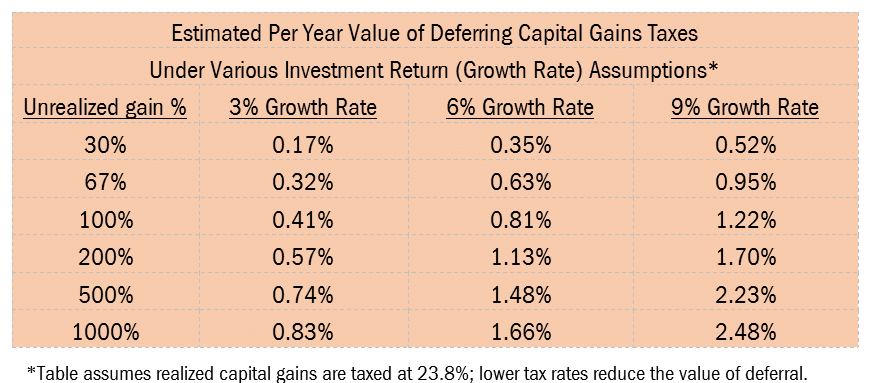

This would eliminate wealthy individuals ability to defer taxation on. Prohibition on the implementation of new federal requirements to tax unrealized capital gains. The main reason you need to understand how unrealized gains work is to know how it will impact your tax bill.

October 25 2021. The tax would apply to people who make more than US 100 million a year for three years in a row or if one makes US 1 billion in annual income. Unrealized gains are not generally taxed.

President Biden said Friday he supports a Democratic proposal to tax billionaires annually on their unrealized investment gains. A proposal to tax unrealized gains is being considered in the Senate. Before you sell any change in an assets value is an unrealized gain or loss.

She said she expected an agreement reflecting a consensus of all 50 senators on the tax and revenue portion of the bill to emerge early this week. If you want to take this capital loss on your tax. The Secretary of the Treasury including any delegate of the Secretary or any other Federal Government official shall not require or impose the implementation of.

Just imagine that you paid 1000 to purchase a stock this year and on December 31 2021 it is valued as 2000 based on then current stock prices. With their latest tax proposal Democrats are going after an elusive target. Democratic leadership over the weekend began suggesting a new way to pay for President Bidens multitrillion-dollar social policy and climate action spending bill a tax on wealthy peoples unrealized capital gains.

President Bidens 2 trillion spending package continues to stall as senior Democrats are hoping to finalize a proposal on a new annual tax. WASHINGTONA new annual tax on billionaires unrealized capital gains is. Unrealized losses are on paper only and not a reportable tax transaction she said.

If it passes what is the point in investing in the. Requiring investors to pay taxes annually on their unrealized gains would end a longstanding rule that says levies arent due to the IRS unless an asset is sold. Global asks Democrats are trying to pass a bill to tax unrealized capital gains on a yearly basis.

Senate Finance Chairman Ron Wyden D-Ore has pushed for years to.

Crypto Tax Unrealized Gains Explained Koinly

What Is Unrealized Gain Or Loss And Is It Taxed

Crypto Tax Unrealized Gains Explained Koinly

Stop Worrying About The Unrealized Gains Tax Are You Insanely Wealthy Already No Cool Then It Doesn T Apply To You It S Fud Billionaire Fud R Superstonk

What S In Biden S Capital Gains Tax Plan Smartasset

The Coming Tax On Unrealized Capital Gains Nomad Capitalist

The Billionaire Tax Proposal A No Good Awful Terrible Idea Youtube

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too

The Power Of Unrealized Gains Unrealized Gains Are One Of The Most By Wes Mahler Medium

High Class Problem Large Realized Capital Gains Montag Wealth

Unrealized Gains And Loses Example Of Unrealized Gains And Losses

Democrats Unveil Billionaire S Tax On Unrealized Capital Gains

Taxing Unrealized Capital Gains A Bad Idea National Review

Build Back Better Legislation Tax On Unrealized Capital Gains Does Not Pass The Fairness Test Ethics Sage

Unrealized Capital Gains Tax Stock Bitcoin Bitcoin Magazine Bitcoin News Articles Charts And Guides

Will The Unrealized Capital Gains Tax Proposal Apply To Most Investors The Motley Fool

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)